Here are some strategies that can help you dig out of holiday debt

Although some Us residents are however recovering from getaway festivities, many others might have lingering effects of paying regrets. All round U.S. retail income enhanced 7.6{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} yr-in excess of-12 months involving Nov. 1 and Dec. 24, in accordance to the most recent Mastercard SpendingPulse study.

For a lot of customers, the amount of money of personal debt they took on to fork out for vacation purchases grew as very well. A new LendingTree examine found 35{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} of Individuals amassed holiday break personal debt in 2022. The average volume was $1,549, the highest amount considering that 2015 when the study was to start with taken. And 37{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} of those getting on holiday financial debt claimed it would just take them at minimum 5 months to fork out it off.

If you want to spend off your getaway financial debt well in advance of this summer season, right here are seven techniques you require to acquire now.

1. Pay out off a established sum of personal debt in 3 to 5 months

2. Perform on increasing your credit score

If your credit history rating is “superior” to “fantastic” — a FICO rating of 670 or better on a scale of 300 to 850 — you happen to be much more probable to qualify for reduced fascination premiums on credit history playing cards, motor vehicle loans and mortgages, professionals say. So obtaining a excellent rating can have a spectacular impact on the value of your financial debt. The more you lower the price tag of the financial debt, the quicker you can pay it off.

Some credit rating card corporations will present your credit history rating for no cost. It really is normally on your billing statement. To enhance your rating, start out by checking your credit rating report and disputing any errors.

Sdi Productions | E+ | Getty Photos

By the stop of 2023, you can get a no cost weekly duplicate of your report from each and every of the key credit history bureaus — Equifax, Experian and TransUnion — at annualcreditreport.com.

Of program, you ought to pay your payments on time each time.

Also, really don’t get much too near to your credit restrict on your playing cards. Making use of fewer than 30{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} of your out there credit score can help you sustain your rating, credit history professionals say, though making use of much less than 10{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} can essentially enable elevate that quantity.

3. Utilize for a {d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} curiosity balance transfer credit card

Implement for a card with an introductory {d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} once-a-year share fee give on stability transfers. Transfer your existing credit score card balances to that new card. You may possibly be billed a 3{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} price on the amount you transfer, but you can pay out no desire on your personal debt for 12 to 20 months.

“A {d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} equilibrium transfer card, if you have excellent plenty of credit score to get a person, is the best weapon against credit card credit card debt,” reported Matt Schulz, chief credit rating analyst at LendingTree. “You can get practically two a long time with out getting interest.”

Again, you frequently have to have a fantastic or outstanding credit score rating to qualify for the greatest gives. Also, you possibly is not going to be ready to do a balance transfer with the similar card issuer.

4. Talk to your credit card issuer to reduce your amount

Sewcream | Istock | Getty Photos

If you will not question for a decrease level, you will not likely get it. But if you do question, you in all probability will. A Lending Tree survey located 70{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} of persons who requested for a lower interest fee on a card obtained one particular, and the normal reduction was seven share details.

Building this mobile phone simply call now is extra significant than ever. After seven consecutive interest level hikes from the Federal Reserve, the ordinary price on a credit rating card is about 23{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9}. Charges on retail store credit playing cards are over 30{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9}.

Asking for a decreased price “is a superior hedge in opposition to the Fed increasing costs once more and towards the skyrocketing prices we’ve seen around the earlier year,” Schulz mentioned.

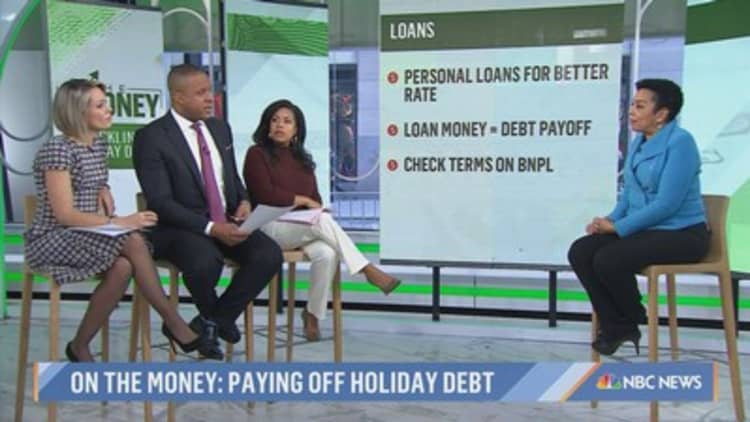

5. Consolidate debt with a individual bank loan

If you cannot get a {d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} offer or lessen rate on a card, try out making use of for a personal financial loan. If you qualify for a huge sufficient bank loan with a decreased interest fee than your latest card’s rate, then you can consolidate all or most of your credit score card personal debt with that bank loan.

In early December, the common rate on a private bank loan was 10.64{d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9}, a lot less than 50 {d0229a57248bc83f80dcf53d285ae037b39e8d57980e4e23347103bb2289e3f9} as a lot as the typical credit score card charge, according to Bankrate.com.

Just you should not commit that loan revenue. If you just take out a personalized financial loan to pay out off credit history card credit card debt, make guaranteed you instantly pay back off your card balances with the money from the mortgage.

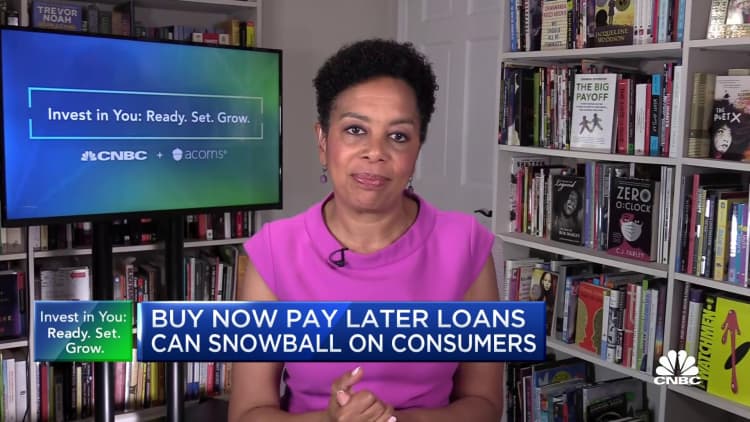

6. Double-look at the phrases of buy now, shell out later on financial loans

About 1 in 10 individuals planned to use invest in now, fork out afterwards financial loans to make vacation purchases, in accordance to the PwC survey. You make an upfront payment with invest in now, pay back afterwards merchandise, then pay out off the rest of the order in a predetermined variety of installments.

Invest in now, pay out later on strategies frequently really don’t demand desire unless of course you overlook a payment. If you skip a single, you could get strike with desire on the unpaid harmony, as effectively as a late price. So make positive you double-verify the conditions of the invest in now, shell out later offer, and comply thoroughly.

7. Get to out to a nonprofit credit counselor

Get a comprehensive evaluation of your economic scenario and a glimpse at your credit history obligations — credit history cards and loans — for absolutely free from a credit rating counselor. When you operate with a nonprofit credit counseling agency that is part of the Nationwide Basis for Credit score Counseling, you can expect to shell out no rate for the original counseling session.

“The result of the session outcomes in the shipping of an motion system, pinpointing every single probable solution for enhancing economical perfectly-currently being and managing financial debt,” said NFCC senior vice president Bruce McClary.

The counselor might propose coming up with a “personal debt administration strategy” between you and card issuers or creditors to amend your primary payment settlement. That strategy could enable you to lengthen your reimbursement term, reduced the curiosity price, and/or waive costs. You’ll however have to pay out in complete, just underneath additional manageable circumstances.

Charges are typically billed for a debt management program, McClary claimed, with a software activation fee of $40 to $50 and every month service fees of $25 to $35. The price can vary depending on the total of credit card debt that is section of the approach or the range of accounts involved.

Indicator UP: Money 101 is an 8-week learning course to economic flexibility, delivered weekly to your inbox. For the Spanish edition, Dinero 101, click on below.