10 Best Money Tips of All Time From Dave Ramsey

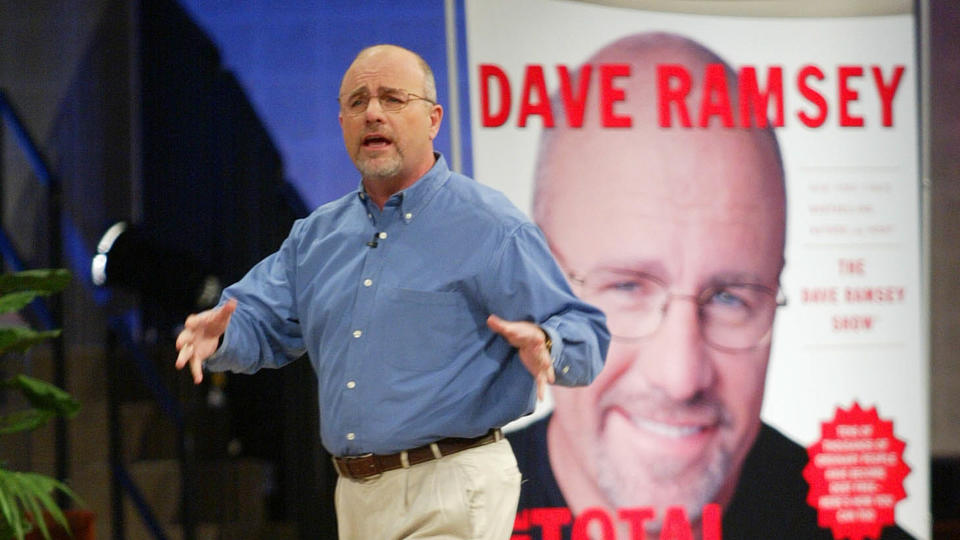

Dave Ramsey has gone from riches to rags and again again, and through it all he’s developed a technique of making use of prevalent sense to take care of money responsibly. He’s shared these steps to economic wellbeing by publications like his bestselling “The Complete Revenue Makeover” and on his nationally syndicated radio plan, “The Dave Ramsey Demonstrate.” Ramsey has assisted thousands and thousands of men and women get back management more than their cash and generate higher financial accomplishment and peace.

See: Superstars Who Are Even Richer Than You Think

Investing: 3 Factors You Have to Do When Your Discounts Attain $50,000

One particular of Ramsey’s top rated recommendations to the GOBankingRates viewers is: “Tell your income what to do instead of wondering where by it went. Individuals know what they require to do with their money, but they just really don’t do it. Be proactive with your income — do a spending plan, get rid of financial debt and save.”

This suggestions echoes substantially of what Dave Ramsey has taught all through the several years. These highlights of Ramsey’s very best money guidelines are a terrific way to get you enthusiastic to boost your private finances this thirty day period and as a result of 2023.

1. Make a Funds Prepare

“The trick in most people’s life is that they do not even identify wherever they want to go,” Ramsey reported on his web page. “They really don’t even know if they’re getting there. Down South, we phone that ditty-bopping together — ditty-bopping via daily life.” Acquiring via life devoid of a treatment in the entire world and expecting many others to treatment for you is no very good feat. He additional:

“That’s called being a kid. Adults devise a plan and abide by it. Small children do what feels great.”

Staying proactive with your dollars can take perform, but it’s what you ought to hope out of yourself. Start by creating a economical plan. Figure out what you want for your finances and make the adjustments that will get you and your dollars on the correct keep track of.

Consider Our Poll: Are You Scheduling To Obtain or Market a Residence This Calendar year?

2. Find the Braveness To Transform

At the time you determine what you want and have an thought of how to get there, it’s time to begin making modifications. But improve can be distressing, claimed Ramsey, and that ache deters a lot of folks from ever tackling their finances just before matters get out of control. For most people today, he said:

“Not until eventually the pain of the very same is bigger than the ache of alter will you embrace transform.”

You have to start off carrying out otherwise if you want a different consequence, Ramsey stated. “Twelve-steppers say if you go on to do the identical detail around and above again and anticipate a diverse consequence, which is the definition of madness. You have to alter the path.”

3. Control Your Money

The moment you have a program, you can put it into action. As you take manage of your cash, you are going to make certain it’s heading wherever it needs to. On this, Ramsey mentioned:

“You have to acquire manage more than your cash or the absence of it will endlessly management you.”

He prompt a number of tools that can make handling your cash a lot easier, like the income-envelope budgeting system and his spending budget-tracking software EveryDollar. Try some new cash management units and discover anything that performs for you.

4. Give Every single Greenback a Name

A big portion of proficiently taking care of revenue is, as Ramsey place it, giving every single dollar a name. When you develop a spending plan, “Every greenback has an assignment,” no matter whether it is feeding or housing your family, spending off personal debt or protecting you from life’s unknowns.

“You’re producing each greenback behave. Giving every single greenback a name ahead of the thirty day period begins.”

5. Act Your Wage

An critical section of sticking to a funds is holding your way of life in check, or as Ramsey set it on Twitter:

“Key to successful with money. Live on significantly less than you make! Act your wage. Quit expending like you are in Congress.”

In a client-driven society, it can be too tempting to look at what absolutely everyone has and feel you must be expending additional so you can have it also — even if you just can’t genuinely find the money for it. “‘Stuff’ is good,” Ramsey explained. “Get some, but if the obtaining of ‘stuff’ is your whole intention you will by no means be seriously happy.” Instead of seeking to catch up to your spending, hold your expending within just your money and only get what you can find the money for.

6. Frugal Nowadays, Rich Tomorrow

“We’ve shed our minds in this lifestyle, we definitely have,” Ramsey stated on his radio demonstrate. “And all of it is mainly because persons have been bought stuff, and bought things and sold stuff, and they’ve obtained this entitlement thing” that will make them shell out on merchandise they can’t pay for. Ramsey teaches his followers to resist the urge to shell out. Earning frugal selections is what will make genuine prosperity that lasts:

“If you will are living like no one particular else, later on you can dwell and give like no a single else.”

7. Do the job Really hard To Get No cost of Personal debt

There’s a fantasy that only the abundant are debt-no cost, explained Ramsey. But the real truth is:

“Anyone can develop into personal debt-absolutely free. True financial debt reduction is plain common perception and difficult function.”

Personal debt has turn into a given for many People, but it can result in some of the worst money tension. “We all make blunders, but the query is whether or not you are prepared to take responsibility for your faults,” he additional.

To get out of financial debt, Ramsey proposed his “debt snowball” strategy: Make only the minimum amount payments on all debts, then place excess funds towards the personal debt with the smallest stability. “When you spend off that smallest debt, it presents you a achievement, and you believe you can make it,” Ramsey stated. “Then, when you pay back off the subsequent debt, you comprehend this is likely to do the job, and you pay off the up coming credit card debt.”

8. Don’t Borrow or Cost

Ramsey recommended that you quit borrowing income or charging purchases to a credit score card. It helps make it much too simple to overspend past what you can afford. He even consistently suggests actions like cutting up credit history cards. On living further than your implies, he explained:

“When men and women try to borrow their way into a posture in lifestyle or an ownership of stuff in daily life that they actually simply cannot manage, then they wrestle the rest of their lives shelling out payments on stuff.”

Dave Ramsey’s evaluate for no matter if you can afford to pay for some thing is basic: If you can say, “‘I wrote a examine and paid for it,” then you can afford it. “That’s the definition,” Ramsey said. “If you simply cannot shell out for it in dollars, in complete, on the location, income on the barrel head, you can not pay for it — whatever it is, your car, your garments, your groceries.”

9. Help you save For the Unpredicted

When you don’t have cash in the bank, you’re exposed to the worst of fiscal mishaps and hardships. Even insignificant fees can turn out to be huge setbacks and lead to challenges like credit card debt:

“Ever observe when you are broke anything is an unexpected emergency?”

The way to face these hazards is to establish protection with an emergency fund. Ramsey proposed preserving an crisis fund in two various stages of his 7 Child Ways. First is to get a buffer saved of $1,000, which can aid go over the daily unexpected costs that occur with life. Later (after having to pay off financial debt), Ramsey endorses conserving an crisis fund which is equivalent to many months’ worthy of of costs to help address much more major emergencies like a career decline.

“Weirdest issue transpired when I bought an emergency fund of three to 6 months of bills: I quit owning as several emergencies,” Ramsey reported on Twitter.

10. Devote In the Upcoming

Investing is an significant component of a successful money strategy, and it’s an critical component to money stability. Ramsey recommended dealing with fiscal basic principles like budgeting and personal debt payoff right before investing, but all that is so you can construct wealth without having everything keeping you back again. Investing is how you can use your cash to produce much more prosperity and prosperity, and system for the upcoming:

“When you are investing, you are residing your existence far more in the long term and in the current.”

Ramsey gives some sensible ways for all those starting to invest. To start with, you want to begin contributing to a pre-tax personal savings program and a tax-free of charge personal savings prepare. He also proposed putting some investments in “mutual money that have a winning keep track of report.” Ramsey explained hiring a economic advisor can also enable you fully realize your options, but make certain you’re even now having accountability of your decisions. “Don’t invest in anything at all unless you can easily demonstrate how the investment operates to someone else,” he stated.

A lot more From GOBankingRates

This write-up initially appeared on GOBankingRates.com: 10 Finest Funds Ideas of All Time From Dave Ramsey